Mens, Womens and kids shoes, boots and sandals | Native Shoes

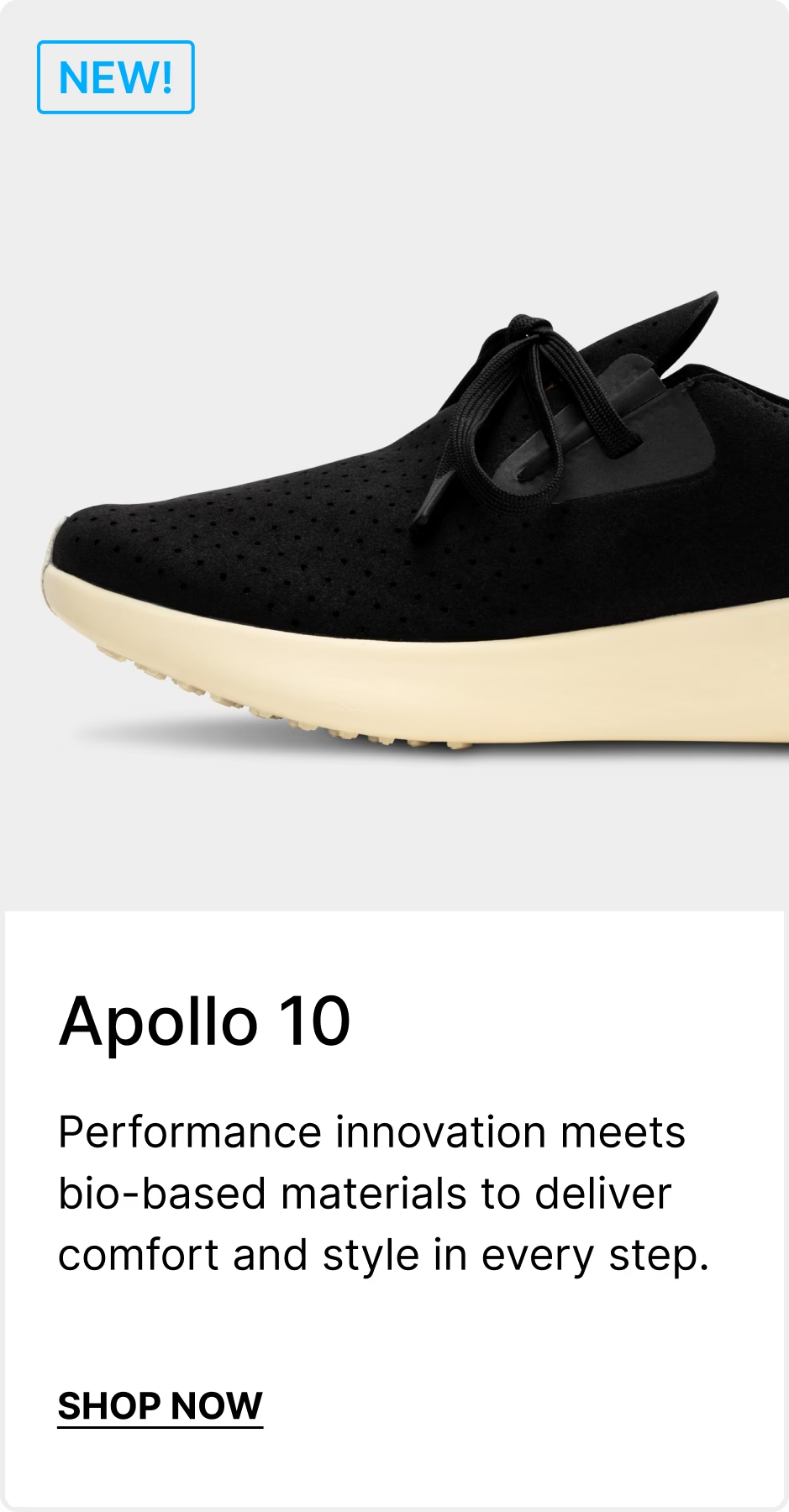

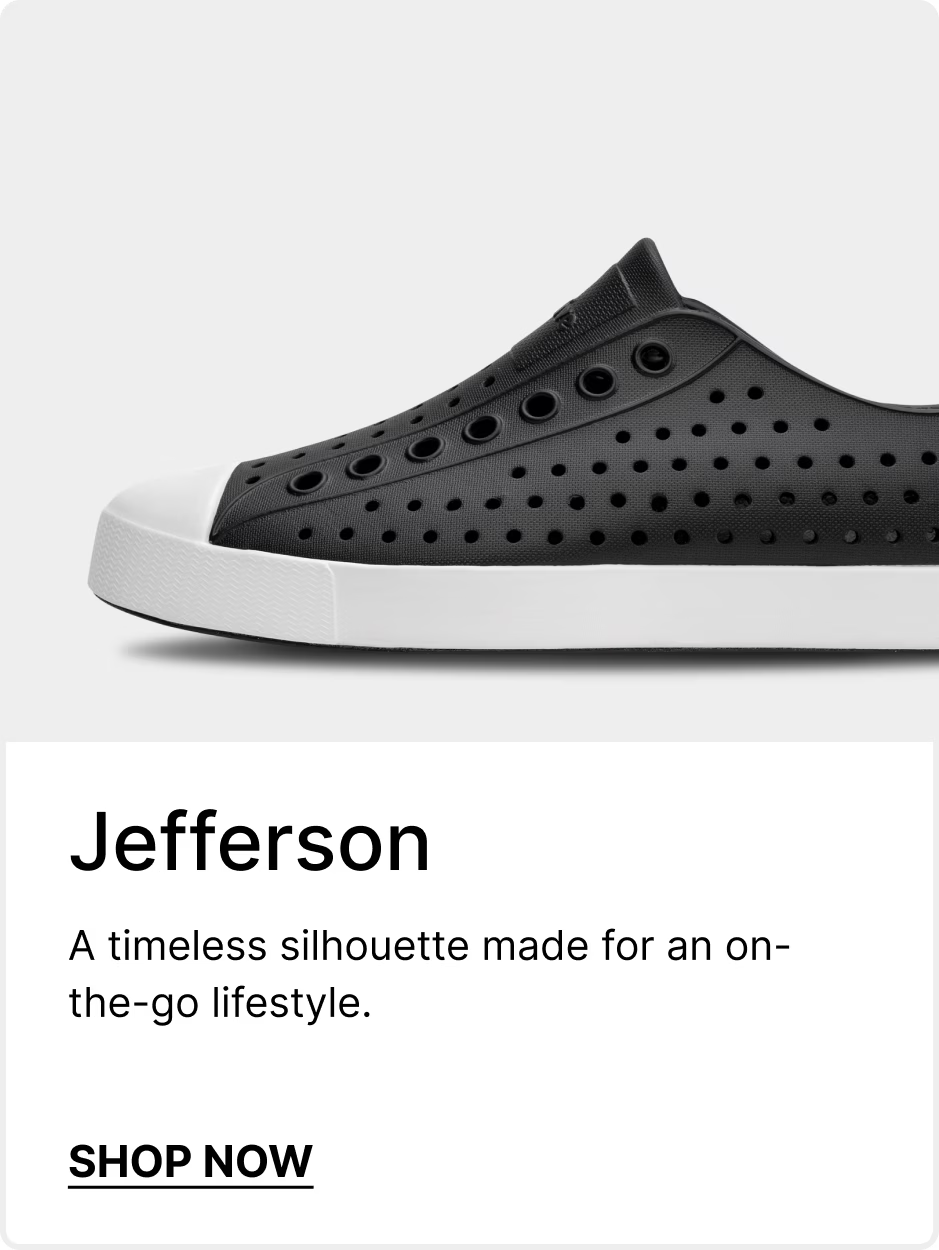

Native Shoes is your go-to for family-friendly, sustainable water shoes, boots, and sandals. We care deeply about people and the planet, which is why we’re dedicated to offering not just fashionable and functional footwear, but styles crafted from eco-conscious, bio-based materials. Native Shoes prioritizes comfort, reliability, and sustainability every step of the way.

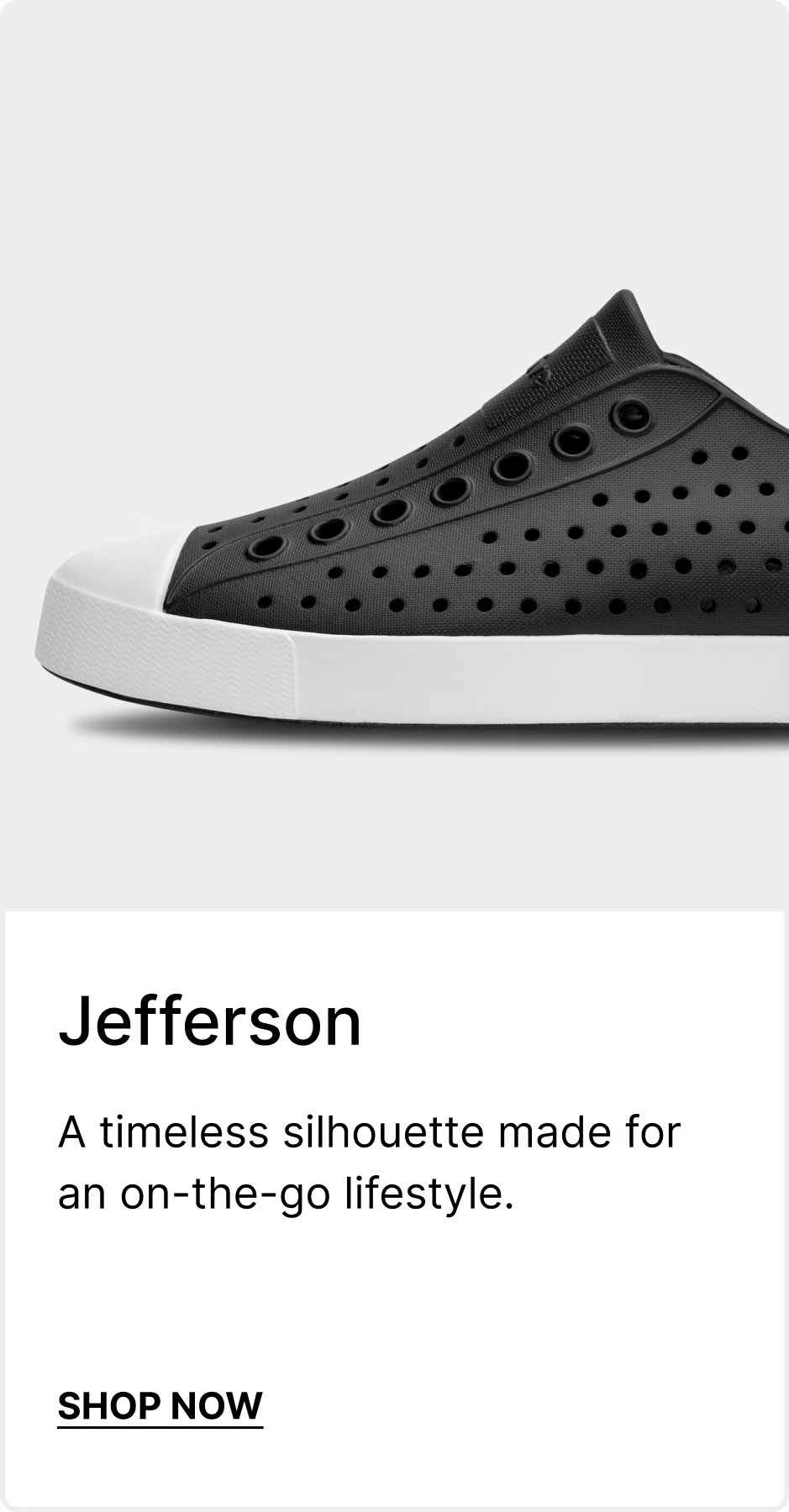

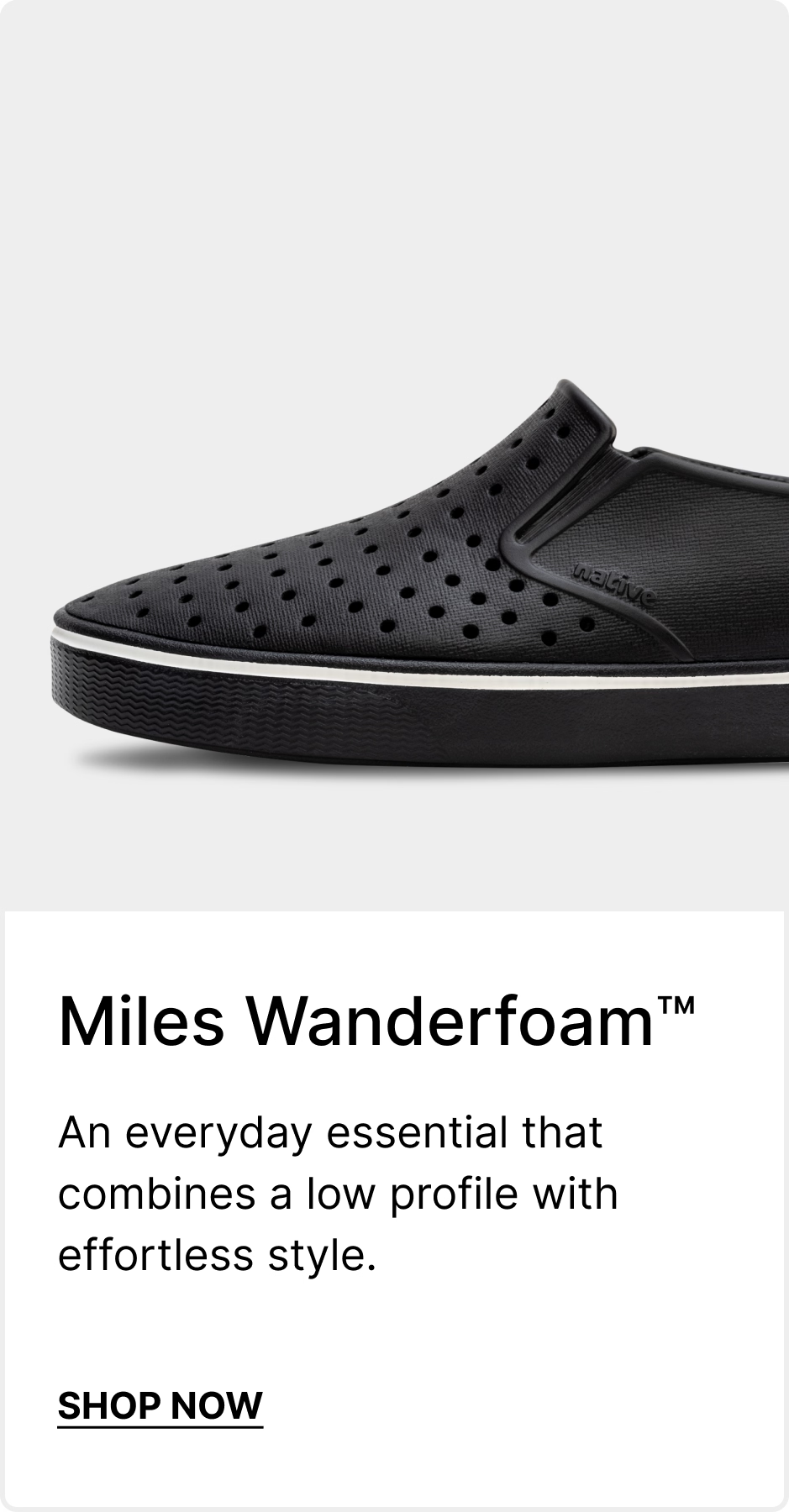

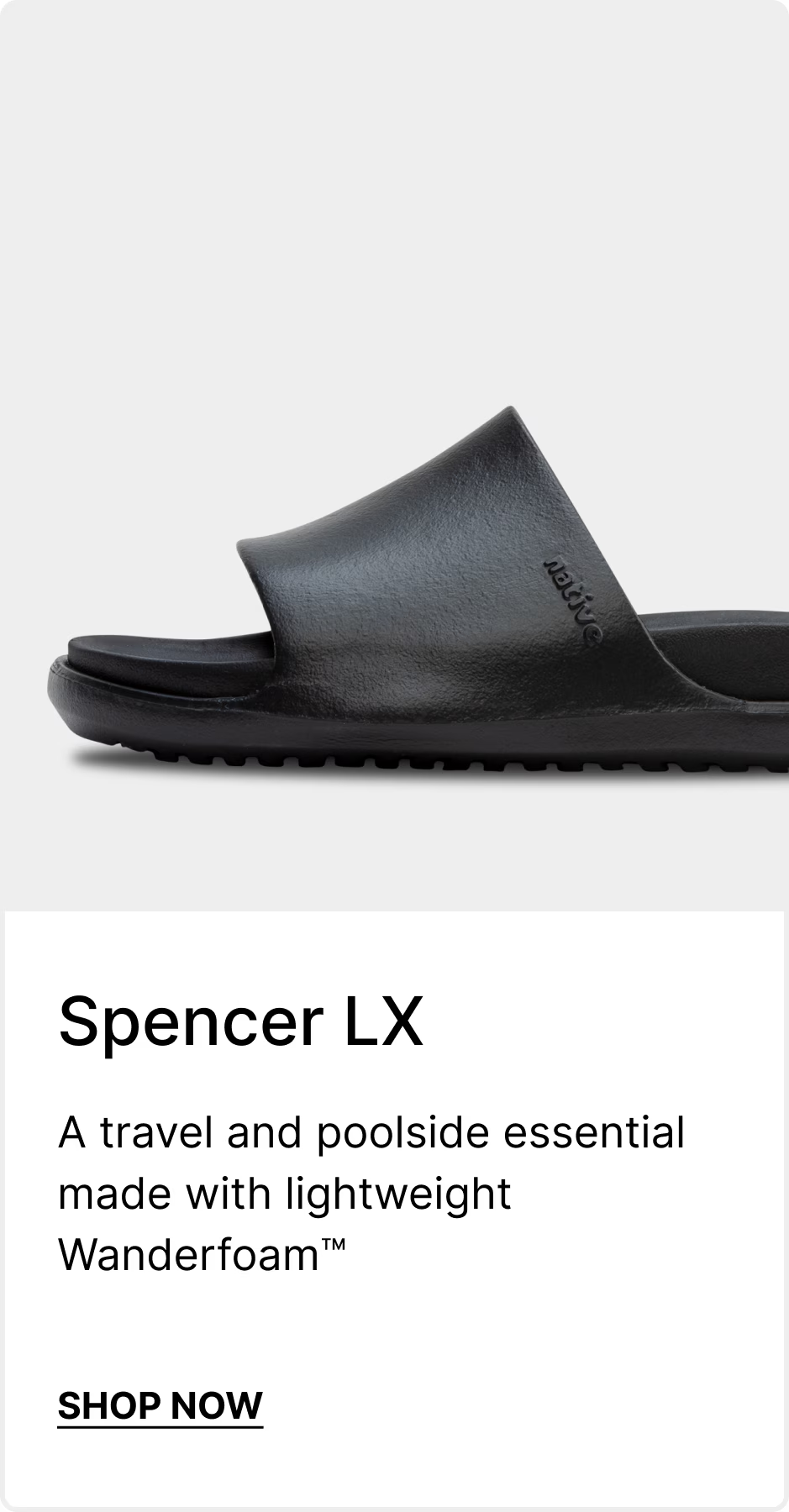

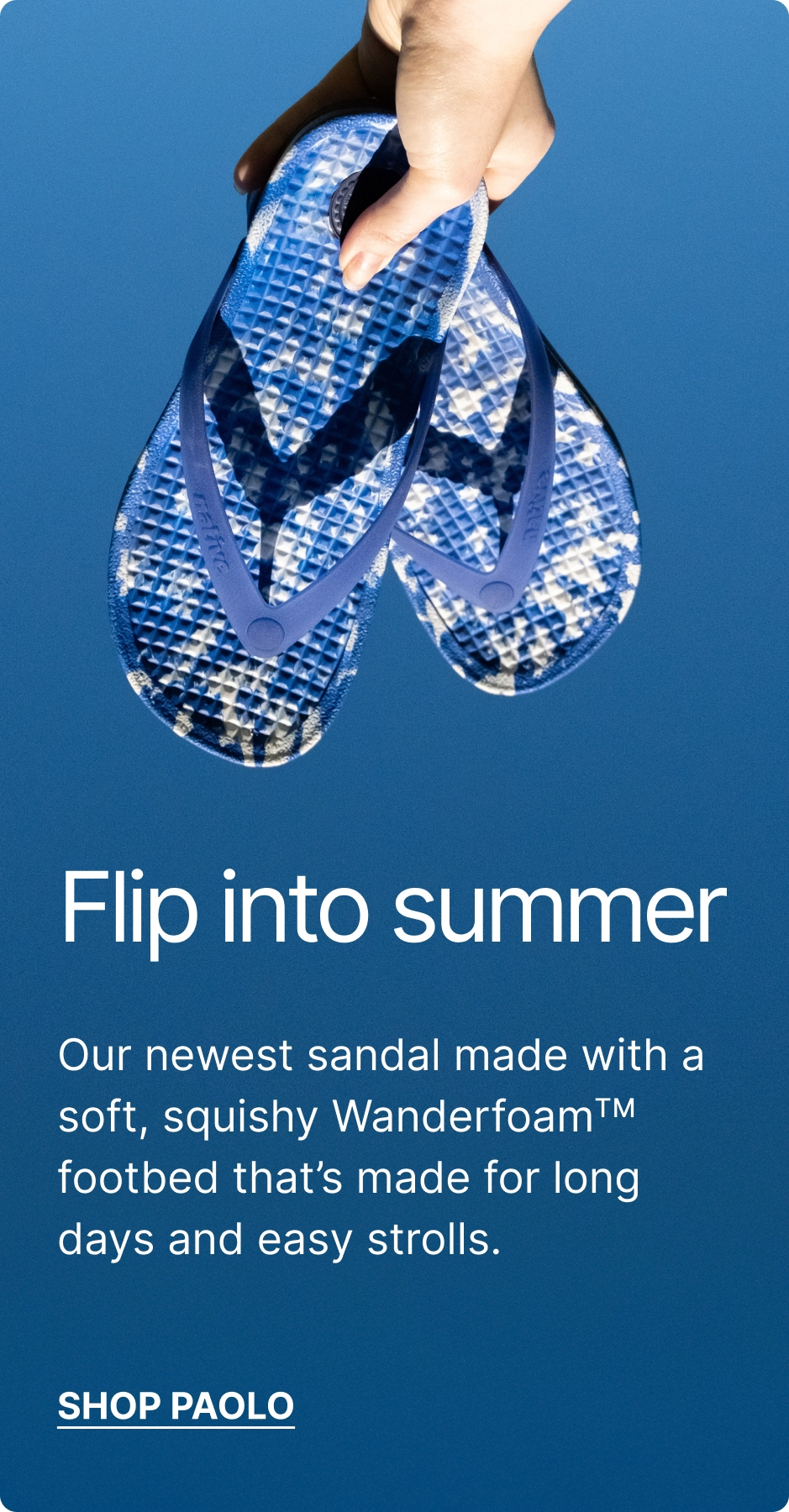

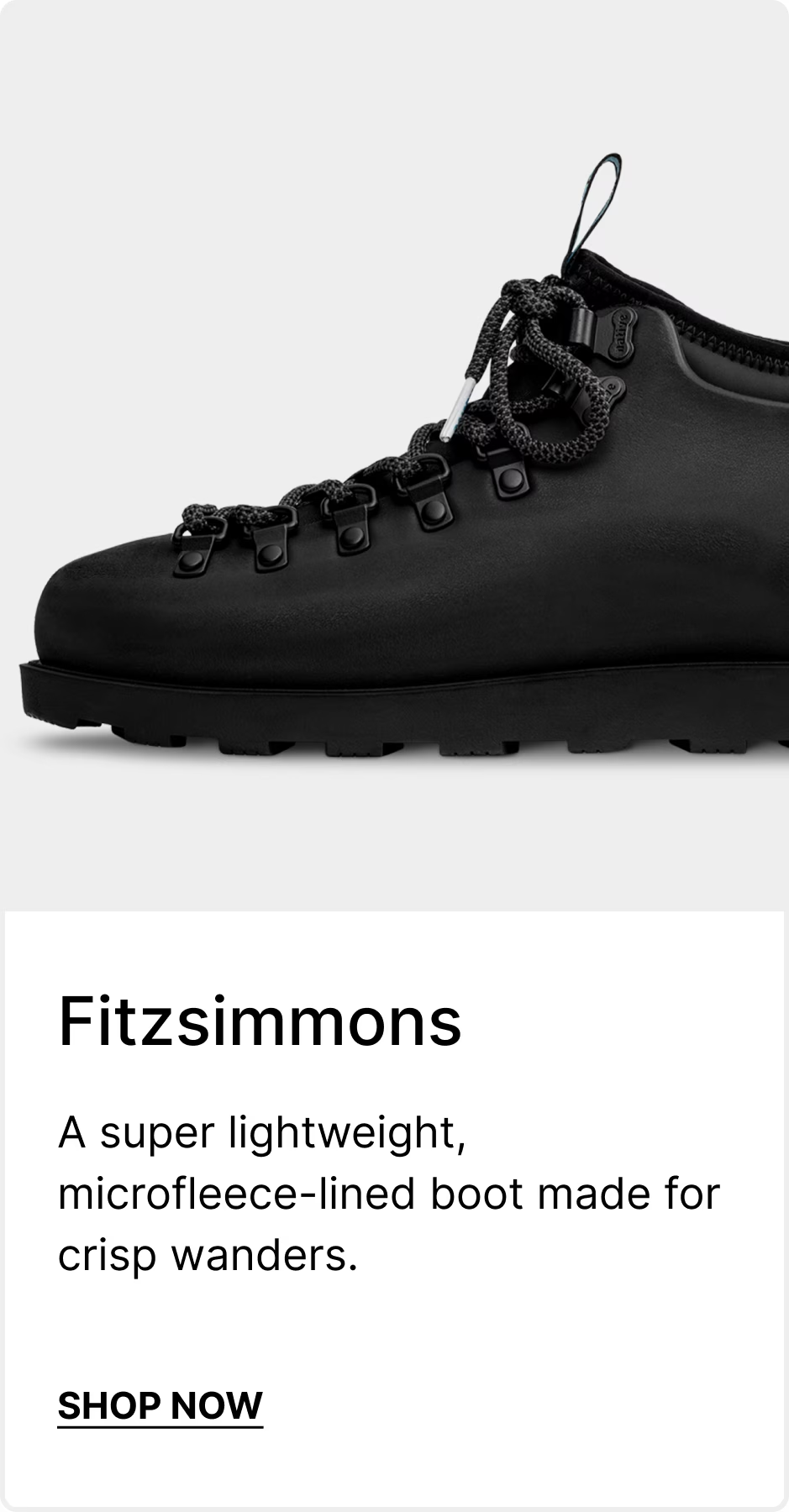

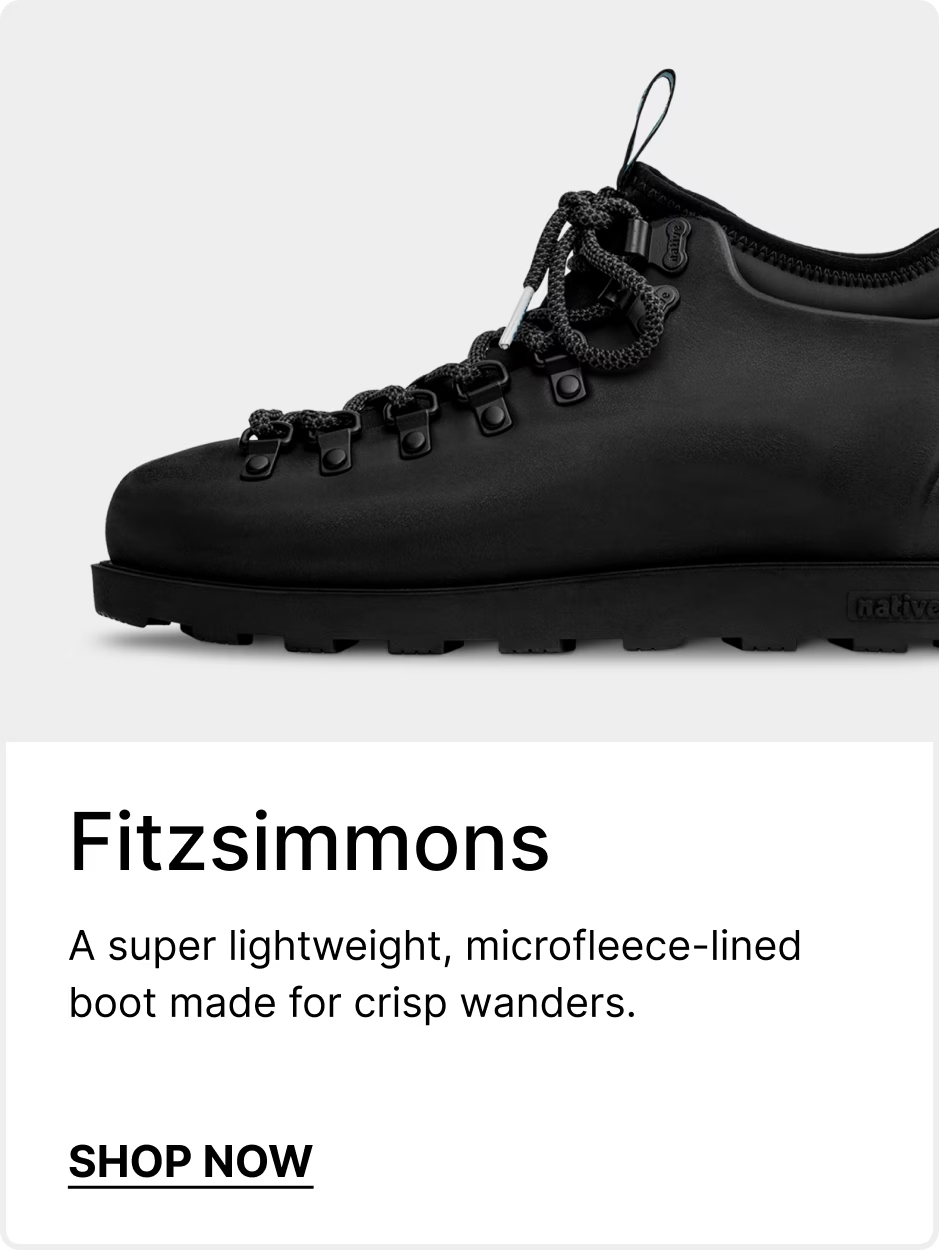

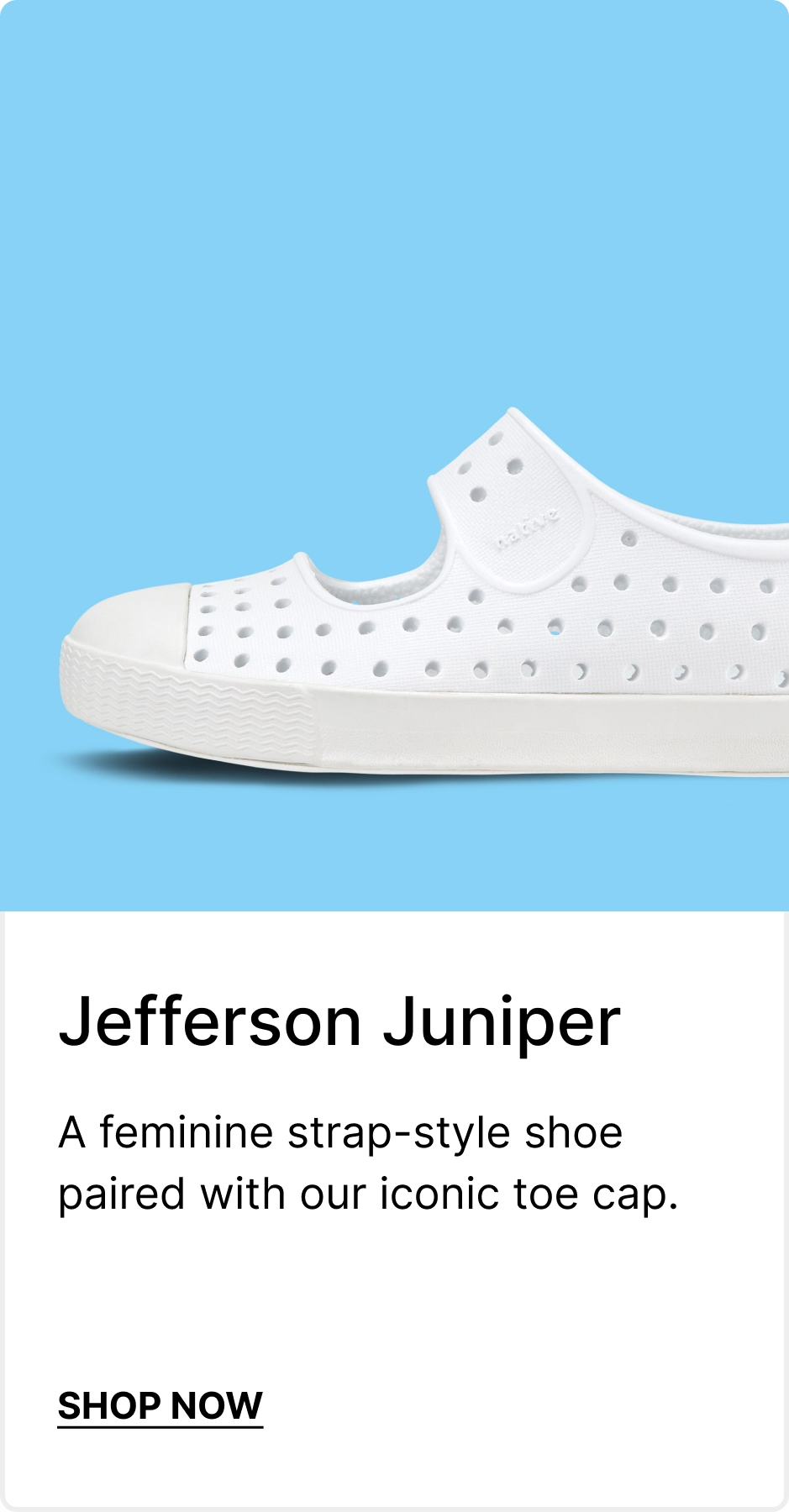

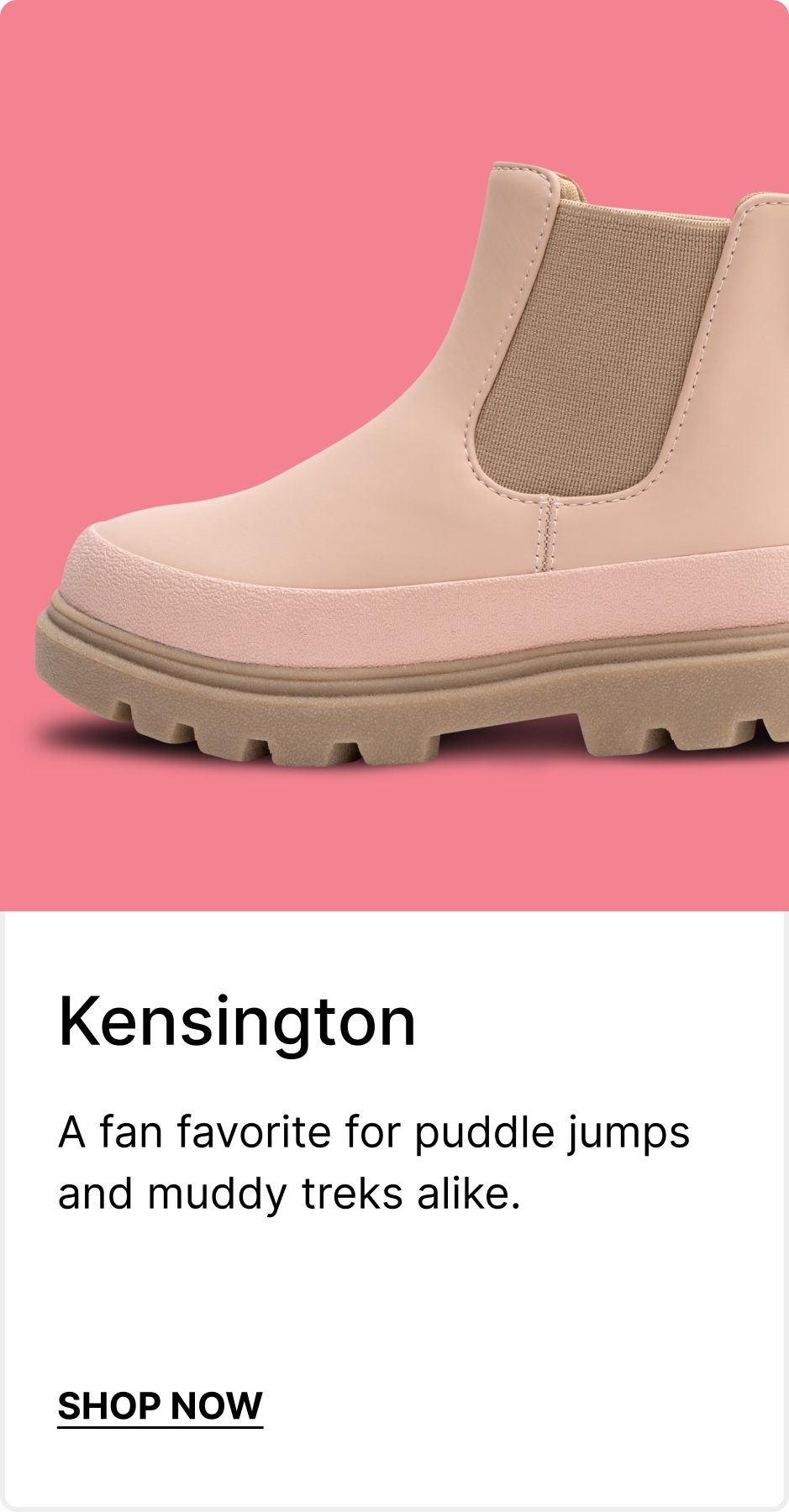

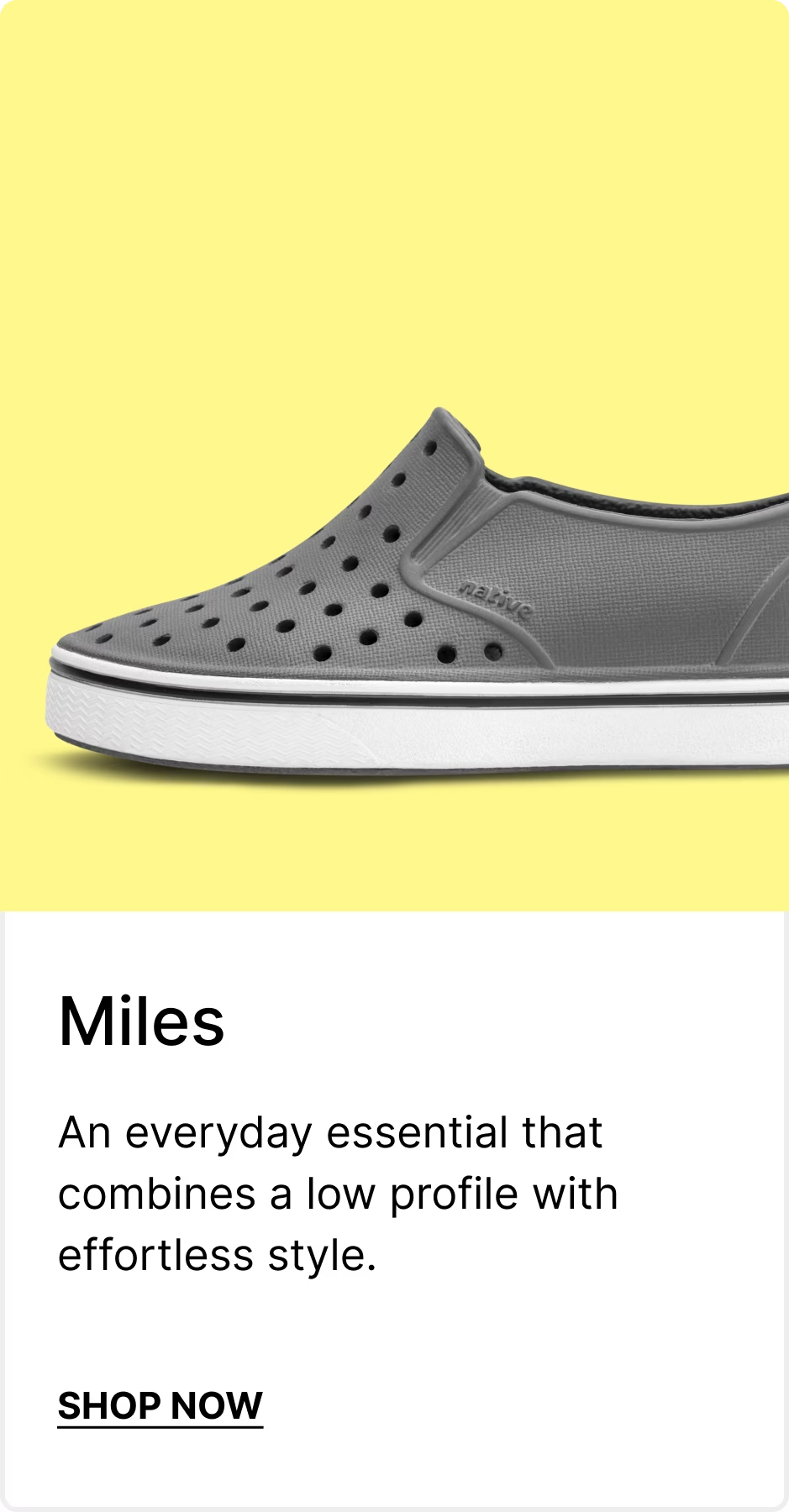

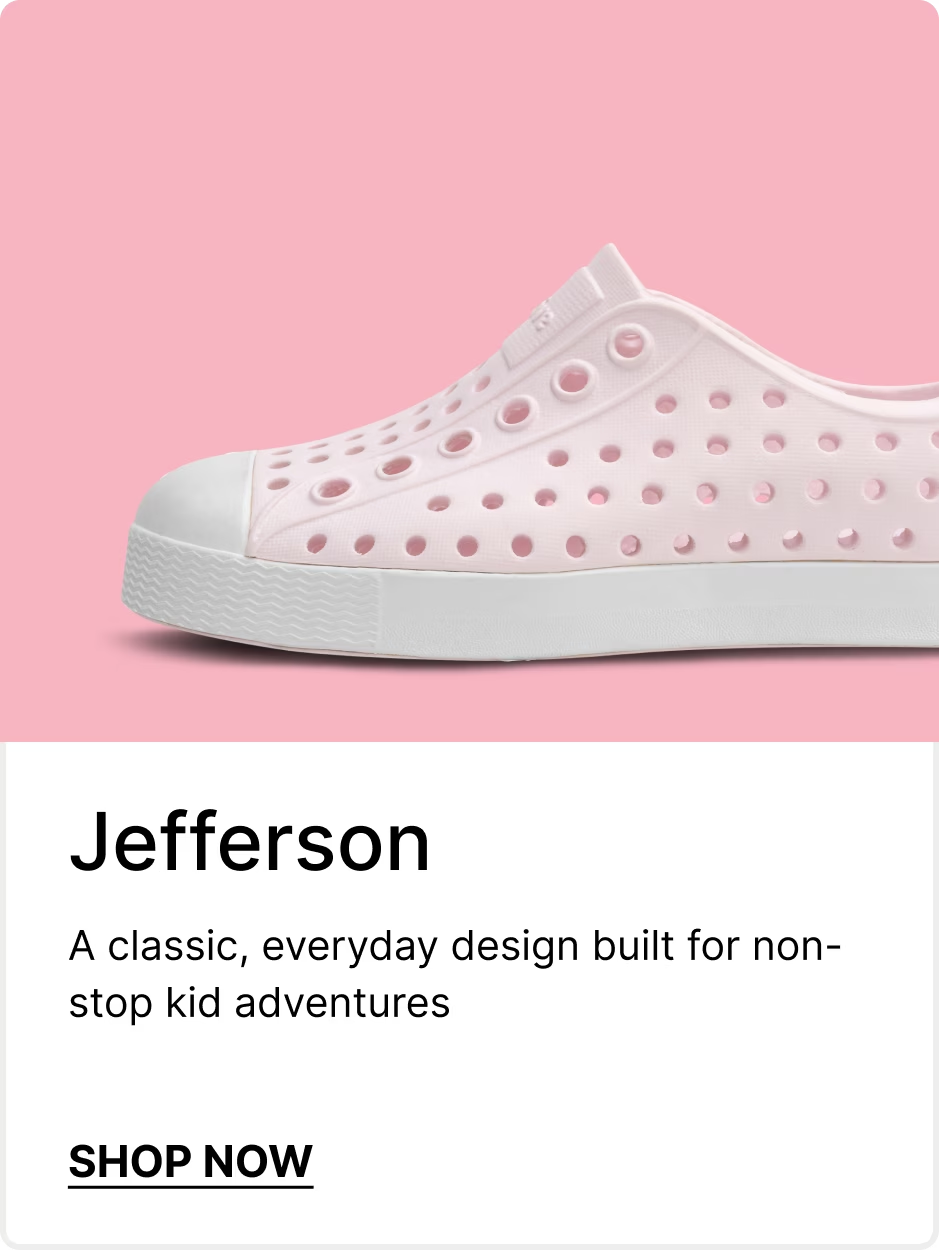

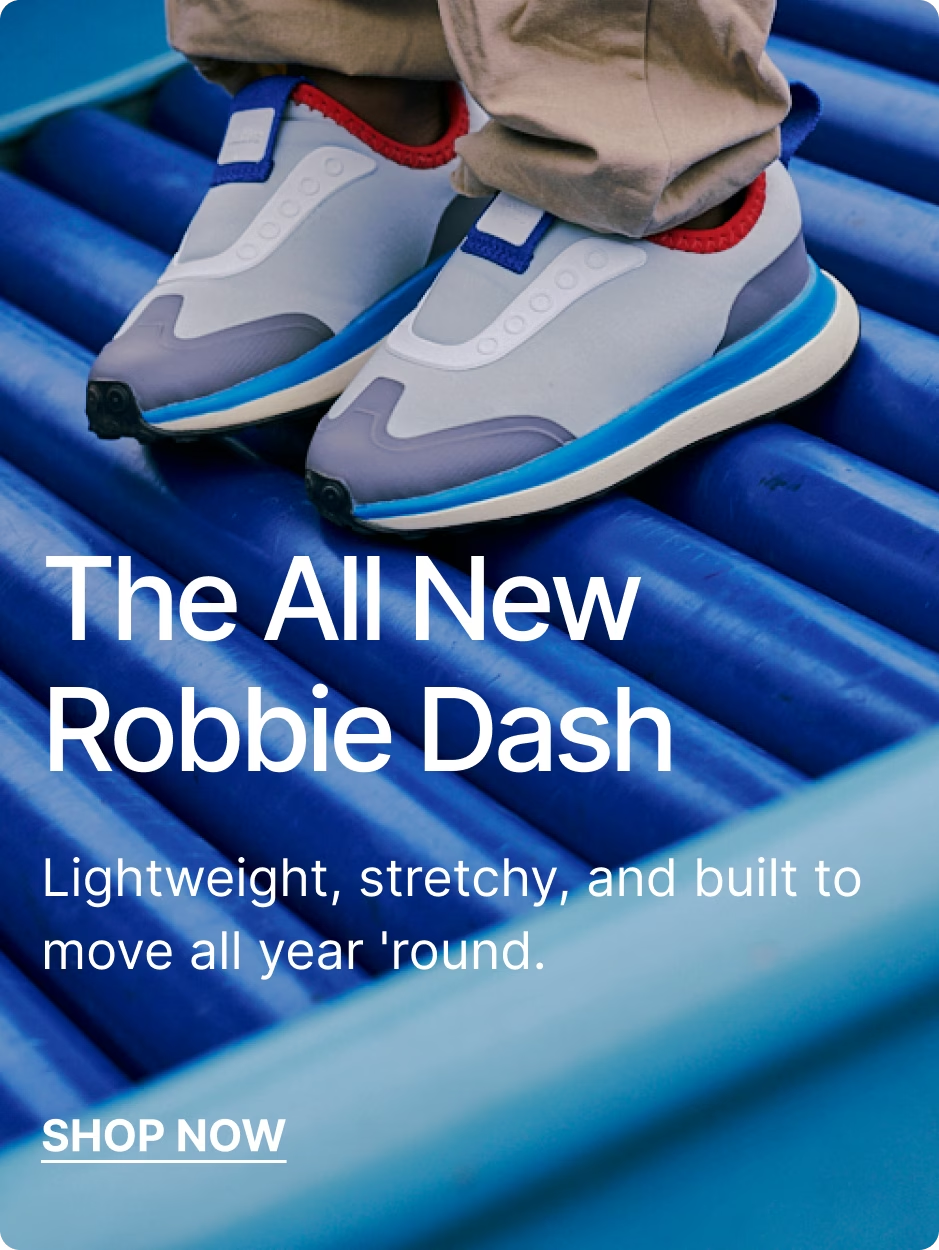

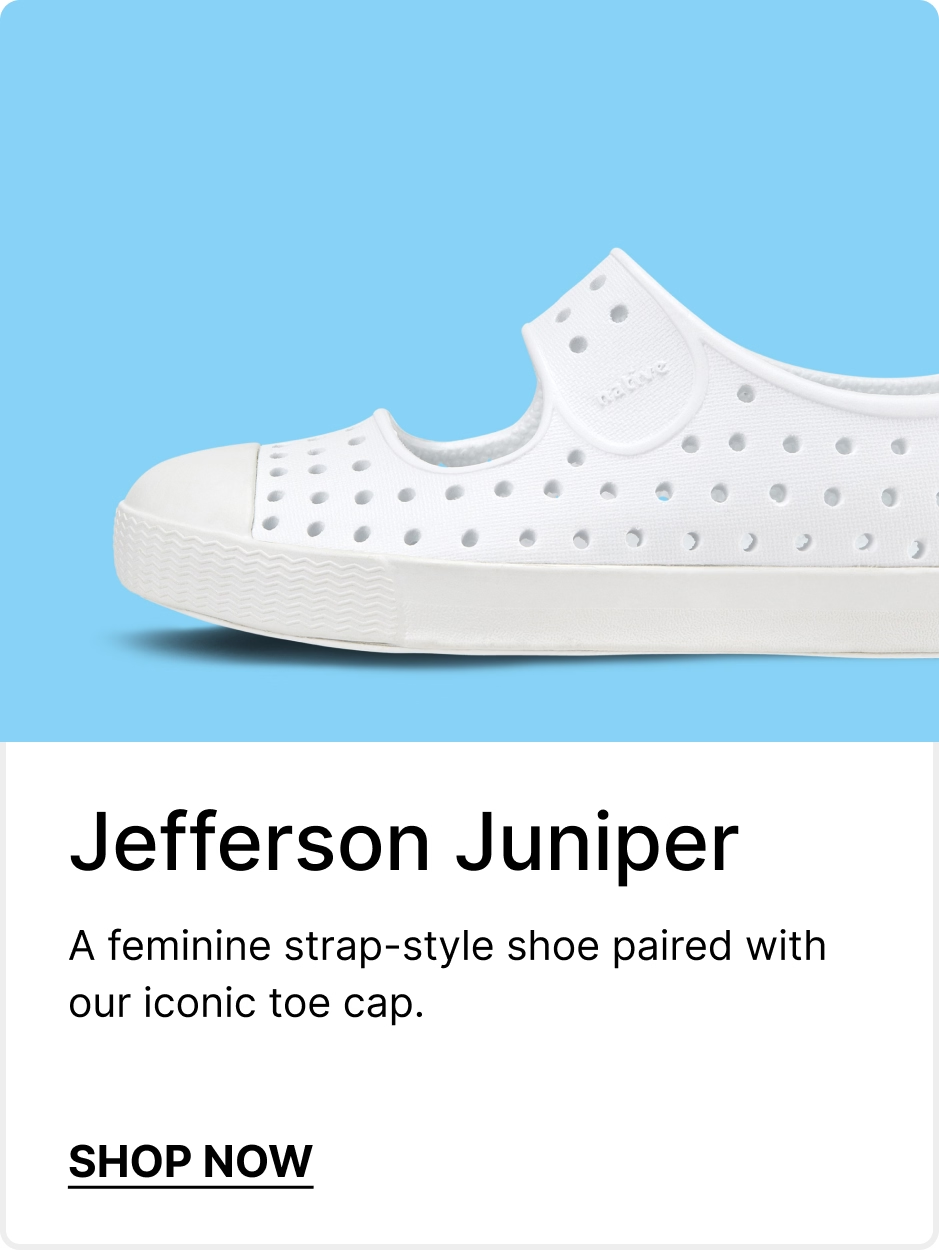

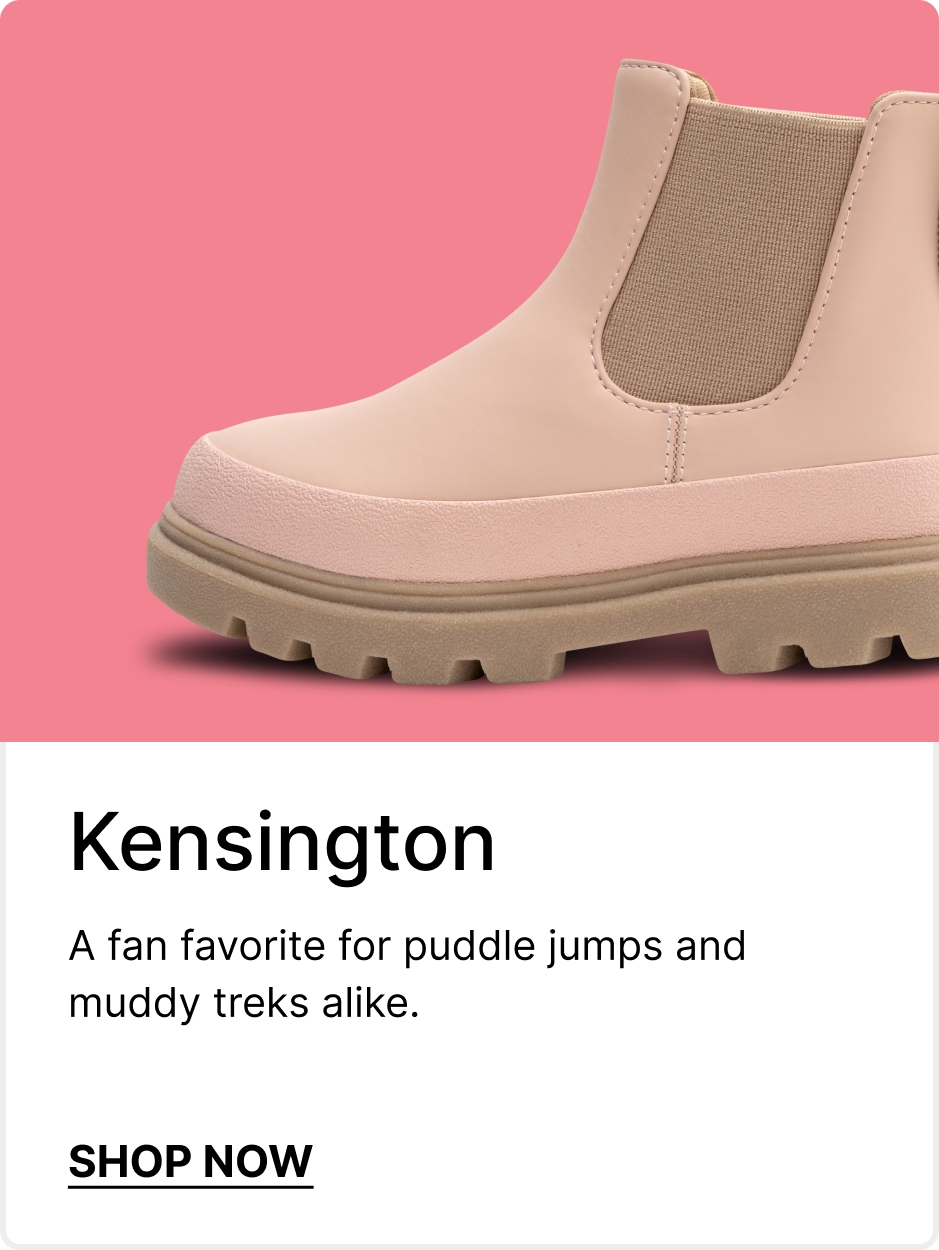

Our diverse range of footwear for men, women, and kids ensures that everyone in the family finds their perfect fit—whether it’s stylish sandals, durable boots, or everyday water-resistant shoes. Crafted with premium materials, Native Shoes emphasizes durability, making them an easy choice for active families who love to explore new waters.

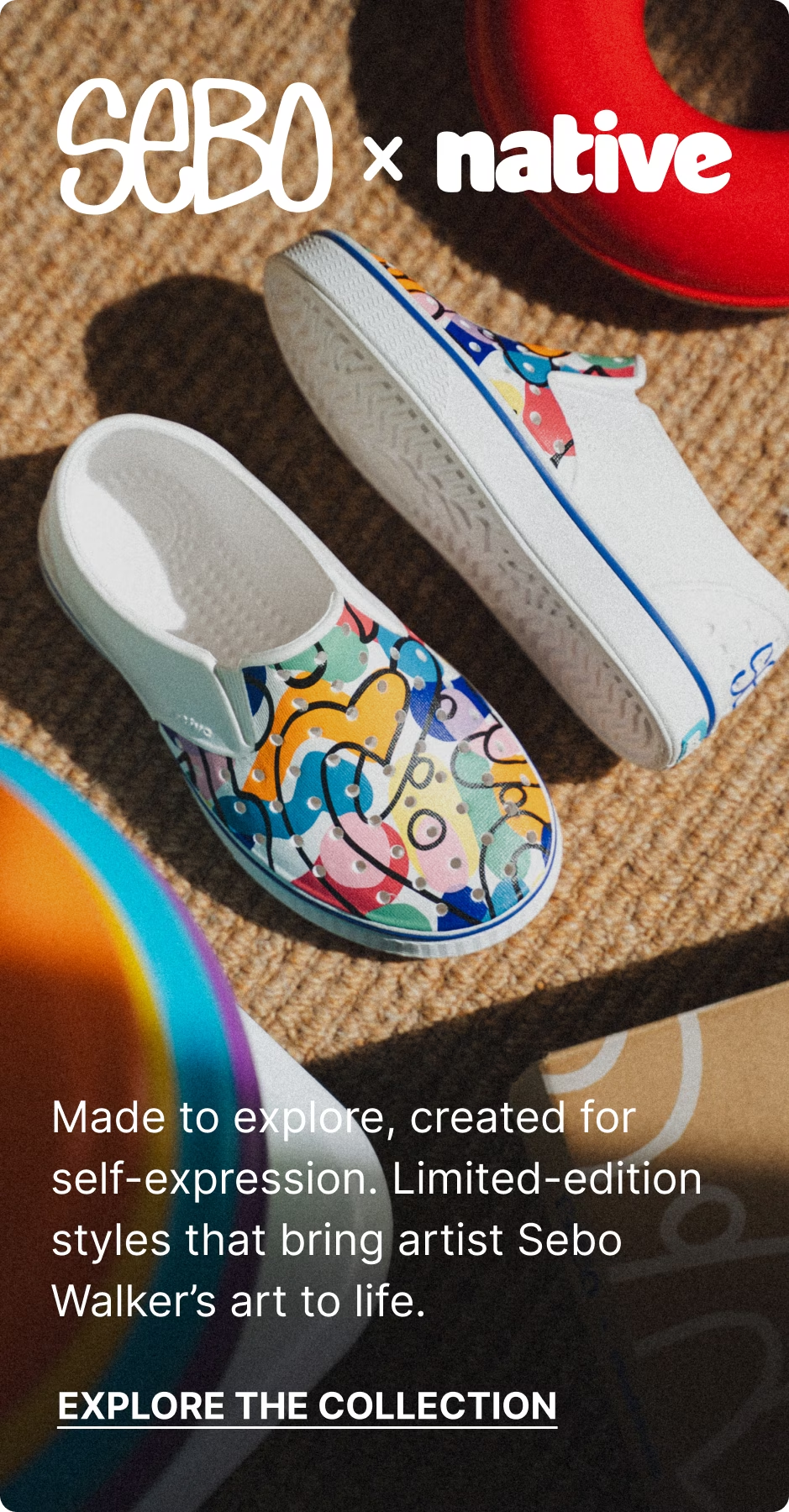

But our mission goes beyond creating family-friendly footwear. Through the use of purposeful sustainable materials, our innovative recycling program (Remix™), and partnerships with kids and adults who share our dedication to leaving a lighter footprint, Native Shoes is committed to making a positive impact. We’re not just creating great footwear, we’re stepping towards a brighter, more sustainable future together.